Global supply chains have faced significant disruptions in recent years, prompting companies to rethink their strategies. You may have noticed the rise of onshoring as a powerful solution to stabilize operations. By focusing on domestic production, businesses can create more resilient injection molding supply chains. This approach ensures greater control over processes and reduces reliance on overseas partners.

The growth of U.S. manufacturing plays a vital role in reshoring efforts. For example, surveys show that 42% of supply chain leaders took steps to nearshore in 2023, compared to just 15% in 2020. This shift reflects the increasing demand for American manufacturing and highlights the potential for long-term growth in domestic industries, driven by the rise of onshoring.

Onshoring refers to the practice of relocating business operations, such as manufacturing or production, back to the same country where the products are sold. This strategy has gained momentum as companies seek to stabilize supply chains and reduce reliance on overseas suppliers. By bringing operations closer to home, you can gain better control over processes, improve quality, and respond faster to market demands.

In recent years, onshoring trends have reshaped global trade dynamics. For example, Mexico surpassed China as the largest trading partner of the United States in 2023. This shift highlights the growing preference for nearshoring and onshoring strategies, which bring production closer to U.S. markets. Additionally, U.S. manufacturing construction spending reached $237 billion in July 2024, an 86% increase from two years earlier. These numbers reflect the rise of onshoring as a critical strategy for supply chain resilience.

While onshoring and reshoring are often used interchangeably, they have distinct meanings. Onshoring focuses on moving production within the same country, while reshoring involves bringing operations back from overseas to the home country. For instance, if your company relocates a factory from China to the U.S., that’s reshoring. However, if you move production from one U.S. state to another, that’s onshoring.

The operational differences between these strategies are significant. Companies that reshore often report quality improvements, with 60% noting better product standards. Reshoring also reduces shipping costs for 40% of businesses and speeds up time-to-market by up to 20%. Onshoring, on the other hand, emphasizes regional optimization, allowing you to build local supplier networks and enhance supply chain flexibility. Both strategies play a vital role in the reshoring revolution, which has created over 350,000 jobs in the U.S. in 2022 alone.

The injection molding industry has experienced a transformative shift due to onshoring. This process, which involves creating plastic parts by injecting molten material into molds, is critical for industries like automotive, healthcare, and consumer goods. Onshoring allows you to address key challenges in this sector, such as long shipping times, high transportation costs, and intellectual property risks.

By relocating plastic injection molding operations closer to U.S. markets, you can achieve faster production cycles and reduce lead times. For example, eliminating overseas shipping delays can accelerate time-to-market, giving you a competitive edge. Onshoring also enhances cost savings by cutting freight expenses and improving operational efficiency. Additionally, it supports compliance with regulations like ITAR, which is crucial for industries requiring strict quality and security standards.

The rise of onshoring has also fueled demand for advanced manufacturing facilities in the U.S. The injection molding sector benefits from this trend, as companies invest in high-tech equipment and automation to boost productivity. This growth is expected to continue, with the U.S. injection molding industry playing a pivotal role in reshoring production and strengthening domestic supply chains.

Geopolitical shifts and evolving trade policies have significantly influenced the rise of onshoring. You’ve likely noticed how global tensions and trade disputes have disrupted traditional supply chains. For example, U.S. tariffs on imported goods, especially from China, have increased costs for businesses. This has made onshoring a strategic choice to reduce risks tied to politically unstable regions.

The U.S. has also diversified its trade relationships, favoring geographically closer partners like Mexico and Vietnam. This shift reflects a broader trend toward nearshoring and onshoring. A recent analysis shows that U.S. imports now involve a 10% reduction in geopolitical distance and a 3% reduction in geographic distance. These changes highlight the growing preference for reliable and nearby trade partners.

| Evidence Description | Key Findings |

|---|---|

| Shift in US Trade Patterns | The U.S. has diversified imports away from China, benefiting Mexico and Vietnam. |

| Geopolitical Distance Reduction | A 10% reduction in geopolitical distance for U.S. imports has been observed. |

| Foreign Direct Investment Trends | China’s outbound investments now focus on developing economies. |

These geopolitical factors make onshoring an appealing strategy for stabilizing supply chains and reducing exposure to international uncertainties.

Economic pressures have also driven the shift toward onshoring. Supply chain disruptions caused by the COVID-19 pandemic forced many companies to reevaluate their reliance on offshore production. You’ve probably seen how delays and rising transportation costs have made offshoring less attractive.

Additionally, tightening ESG (Environmental, Social, and Governance) regulations have increased scrutiny on outsourcing to regions with lax oversight. Companies now face higher expectations from stakeholders to adopt sustainable practices. Onshoring helps you meet these demands by ensuring compliance with stricter domestic regulations.

By addressing these economic challenges, onshoring offers a practical solution for improving supply chain stability and meeting modern business demands.

Advancements in technology have made onshoring more feasible and cost-effective. You’ve probably heard about the surge in automation and smart manufacturing technologies in the U.S. These innovations have reduced labor costs and increased efficiency, making domestic production more competitive.

Recent legislation has spurred over $800 billion in capital investment in U.S. manufacturing. Factory construction has nearly doubled in just one year, reflecting the rapid growth of domestic production capacity. This expansion benefits industries like injection molding, where advanced machinery and automation play a crucial role in meeting demand.

For example, automated injection molding systems can produce high-quality parts faster and with fewer errors. This not only reduces costs but also shortens lead times, giving you a competitive edge in the market. By leveraging these technological advancements, onshoring has become a key driver of growth in U.S. manufacturing.

Consumer preferences have shifted significantly in recent years, with a noticeable increase in demand for American-made products. This trend has become a key driver for reshoring and onshoring efforts, as businesses respond to the growing desire for locally produced goods. You may have noticed that more consumers now actively seek out products labeled "Made in America." Nearly two-thirds of U.S. shoppers prioritize these items, even during challenging economic times. This reflects a strong and consistent preference for supporting domestic manufacturing.

One reason for this increased demand is the perception of higher quality and safety standards in American-made products. Many consumers believe that U.S. manufacturing offers better oversight and stricter regulations, ensuring reliable and safe goods. Additionally, a growing segment of buyers is willing to pay a premium for these products. This willingness stems from a desire to support local jobs and contribute to the national economy. By choosing American-made items, you can feel confident about the quality while also making a positive impact on your community.

The 2024 Kearney Reshoring Index highlights this shift in consumer behavior. Between 2022 and 2023, there was a 5 percent increase in U.S. consumers opting to "buy American." This trend aligns with the broader movement toward reshoring, as companies work to meet the increased demand for domestic goods. Businesses that embrace onshoring can tap into this growing market, strengthening their connection with customers who value locally produced products.

Tip: Highlighting the "Made in America" label on your products can help you attract customers who prioritize quality and local support.

The increased demand for American manufacturing also reflects a deeper cultural shift. Consumers are becoming more conscious of their purchasing decisions and their impact on the environment and society. By choosing domestically produced goods, you can reduce the carbon footprint associated with long-distance shipping. This aligns with the values of sustainability and responsibility that many shoppers now prioritize.

For businesses, this shift represents a significant opportunity for growth. By reshoring operations and focusing on onshoring strategies, you can align with consumer preferences and build a loyal customer base. Meeting this increased demand not only strengthens your brand but also contributes to the revitalization of U.S. manufacturing.

Onshoring strengthens your supply chain resilience by reducing reliance on distant suppliers and mitigating risks from geopolitical instability. When you move production closer to home, you gain better control over your injection molding supply chain. This allows you to respond quickly to disruptions and maintain consistent operations.

A recent study revealed that more than half of executives plan to increase onshoring or nearshoring between 2023 and 2025. This shift reflects a growing focus on flexibility and resilience over cost. Additionally, foreign direct investment (FDI) in North America has surged by 134% since the implementation of the USMCA, highlighting the region's appeal for manufacturing growth.

| Key Findings | Details |

|---|---|

| Executives prioritizing resilience | Over half plan to increase onshoring or near-shoring by 2025. |

| Growth in FDI in North America | FDI has grown 134% to $219 billion since the USMCA. |

| Manufacturing sector investment | 53% of FDI in Mexico in Q1 2023 was in manufacturing. |

By focusing on shorter supply chains, you can reduce vulnerabilities and ensure smoother supply chain management, even during global disruptions.

The adoption of automation in onshored operations significantly enhances cost-effectiveness. Automated systems streamline processes, reduce errors, and lower labor costs. For example, robotic process automation (RPA) technology costs one-third of an offshore employee and one-fifth of an onshore employee. This makes automation a game-changer for injection molding supply chain management.

| Evidence Type | Details |

|---|---|

| Labor Cost Savings | Automation reduces the need for human labor, leading to significant savings. |

| Cost Comparison | RPA technology costs one-third of an offshore employee and one-fifth of an onshore employee. |

| ROI from RPA Investments | Top performers earned nearly 4X on their RPA investments. |

| Payback Period | Organizations achieve payback on automation investments within 9-12 months. |

By adopting automation, you can achieve shorter supply chains, reduce operational costs, and improve efficiency. This approach ensures your injection molding supply chain remains competitive and cost-effective.

Onshoring supports sustainability by reducing the environmental impact of long-distance shipping. When you source locally, you cut carbon emissions by 25% to 50% compared to importing from overseas. For example, U.S.-made solar panels can reduce emissions by 30%. Additionally, container ships contribute to 3% of global greenhouse gas emissions, emitting 140 million metric tons of CO2 annually. By focusing on sustainability, you can significantly lower your carbon footprint.

Note: Shorter supply chains not only reduce emissions but also align with consumer demand for sustainable products. This shift helps you meet modern expectations while promoting environmental responsibility.

Onshoring also encourages the production of sustainable products by enabling better oversight of manufacturing processes. By prioritizing sustainability in your injection molding supply chain, you can create eco-friendly solutions that appeal to environmentally conscious consumers.

Onshoring significantly improves lead times and delivery reliability by bringing production closer to your customers. When you reduce the distance between manufacturing facilities and end markets, you can eliminate delays caused by long shipping routes and customs processes. This proximity allows you to respond faster to customer orders and adapt to changing market conditions.

Key performance indicators (KPIs) highlight how onshoring enhances supply chain efficiency. For example, the inventory turnover ratio measures how quickly you sell and replace inventory, reflecting better stock management. Order accuracy assesses the correctness of fulfilled orders, ensuring fewer mistakes and higher customer satisfaction. Delivery times evaluate the speed of order fulfillment, showcasing the reliability of your supply chain.

| KPI | Description |

|---|---|

| Inventory Turnover Ratio | Measures how often inventory is sold and replaced over a period. |

| Order Accuracy | Assesses the correctness of orders fulfilled. |

| Delivery Times | Evaluates the speed of order delivery. |

On-time delivery (OTD) is another critical metric for assessing supply chain performance. It measures how efficiently you fulfill orders within the promised timeframe. OTD reflects delivery reliability and helps you identify bottlenecks or inefficiencies in your operations. By focusing on these metrics, you can ensure smoother processes and meet customer expectations consistently.

Onshoring also supports the growth of local supplier networks, which further strengthens delivery reliability. By sourcing materials and components domestically, you can avoid disruptions caused by global supply chain issues. This approach ensures that your products reach customers on time, every time.

Tip: Regularly monitor KPIs like OTD and inventory turnover to identify areas for improvement in your supply chain.

Higher domestic labor costs often pose a challenge when transitioning to onshoring. Wages in developed nations are significantly higher than in offshore locations, making labor expenses a critical factor in reshoring decisions. For example, companies must weigh these costs against the benefits of improved productivity and workforce quality. As of May 2023, the manufacturing sector faced 608,000 unfilled jobs, highlighting a labor shortage that drives up wages. This shortage has also pushed businesses to adopt automation as a cost-saving measure.

To address these challenges, you can focus on training local employees to enhance their skills and productivity. While this requires an upfront investment, it ensures long-term benefits by building a skilled workforce. Additionally, leveraging automation technologies can help reduce reliance on manual labor, making domestic production more cost-effective.

Investing in advanced technologies is essential for overcoming onshoring challenges in the injection molding industry. Companies like Mack Molding have led the way by investing over $3 million in new plastic injection molding presses and auxiliary equipment. These upgrades include hybrid presses that improve energy efficiency, reduce cycle times, and enhance precision. Facilities in Vermont and North Carolina have installed presses ranging from 500-ton to 1,500-ton capacities, showcasing the industry's commitment to technological growth.

By adopting such innovations, you can boost productivity and meet the growing demand for high-quality products. Advanced machinery not only reduces production costs but also ensures consistent output, giving you a competitive edge in the market.

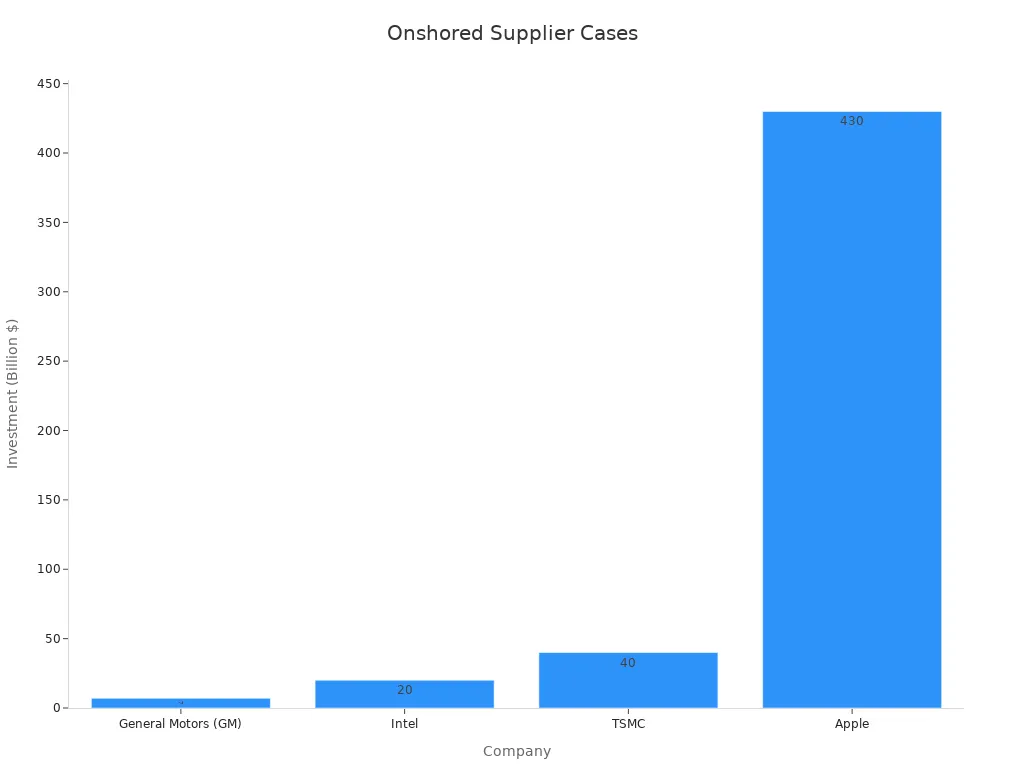

Establishing local supplier networks is another critical step in successful onshoring. Companies like General Motors and Intel have invested billions in domestic supply chain strengthening. For instance, Intel's $20 billion investment in Ohio focuses on semiconductor manufacturing, while TSMC's $40 billion project in Arizona supports chip production. These efforts highlight the importance of building robust local networks to reduce reliance on international suppliers.

By forming partnerships with local suppliers, you can minimize transportation costs and delays. This approach not only strengthens your supply chain but also supports the growth of domestic industries, ensuring long-term stability.

Navigating regulatory and infrastructure hurdles can be one of the most challenging aspects of onshoring. You may encounter complex regulations that vary across states and industries. These differences can slow down your transition and reduce the benefits you expect from onshoring. For example, industries with strict standards, such as healthcare or automotive, often face compliance challenges that delay operations.

Infrastructure gaps also create obstacles. Many companies struggle to track suppliers beyond Tier-1, which increases the risk of disruptions. Without clear visibility into your supply chain, you might face compliance failures or unexpected delays. Addressing these issues requires careful planning and investment in technology to improve supplier tracking and communication.

To overcome these hurdles, you should focus on building strong partnerships with local governments and regulatory bodies. These relationships can help you navigate complex rules and ensure compliance. Additionally, investing in infrastructure improvements, such as digital tools for supplier management, can enhance your supply chain's reliability.

The demand for onshoring continues to grow, driven by the need for stable and efficient supply chains. By addressing regulatory and infrastructure challenges, you can position your business for long-term growth. This approach not only strengthens your operations but also supports the broader movement toward revitalizing domestic manufacturing.

Tip: Collaborate with industry associations to stay updated on regulatory changes and best practices for compliance.

The rise of onshoring has transformed supply chains by reducing risks and improving stability. Shorter supply chains lower transportation costs and lead times, making operations more efficient. This shift also aligns with the growing demand for sustainable practices, as companies adopt eco-friendly materials and energy-efficient technologies. Labor shortages in the U.S. further highlight the importance of onshoring for securing a reliable workforce.

Reshoring has significantly benefited injection molding and U.S. manufacturing. Products that are costly to ship or require frequent design changes are ideal for reshoring. Since 2010, over 47,000 jobs have been reshored in the plastic-based products industry alone. By considering all costs and risks, many businesses find domestic sourcing more profitable and predictable.

Adopting onshoring as a long-term strategy ensures resilience and growth. It strengthens your supply chain, enhances sustainability, and meets consumer expectations for locally made products. By embracing this approach, you can position your business for success in a rapidly changing global market.

Industries like automotive, healthcare, and consumer goods see significant advantages. Onshoring improves supply chain control and reduces risks for these sectors. Injection molding, in particular, benefits from faster production cycles and better compliance with local regulations.

Onshoring drives job growth by increasing domestic manufacturing opportunities. It revitalizes local economies and supports workforce development. For example, reshoring efforts in the U.S. created over 350,000 jobs in 2022 alone.

Yes, automation and advanced technologies make onshoring cost-effective. Automated systems reduce labor expenses and improve efficiency. This offsets higher wages and ensures competitive production costs.

Onshoring reduces the environmental impact of long-distance shipping. By sourcing locally, you cut carbon emissions and align with consumer preferences for eco-friendly products. This approach supports sustainability and builds trust with environmentally conscious buyers.

You may face higher labor costs, regulatory hurdles, and infrastructure gaps. Address these by investing in automation, building local supplier networks, and collaborating with regulatory bodies. These steps ensure a smoother transition and long-term success.