Southeast Asia stands out as a dynamic hub for the injection molding industry in 2025. The region offers immense potential for growth and investment, fueled by its expanding manufacturing capabilities and rising consumer demand. Consider these promising statistics:

Emerging markets across Asia, such as Vietnam and Thailand, are also experiencing rapid industrialization. These developments create lucrative opportunities for businesses seeking to expand their footprint in the molding sector.

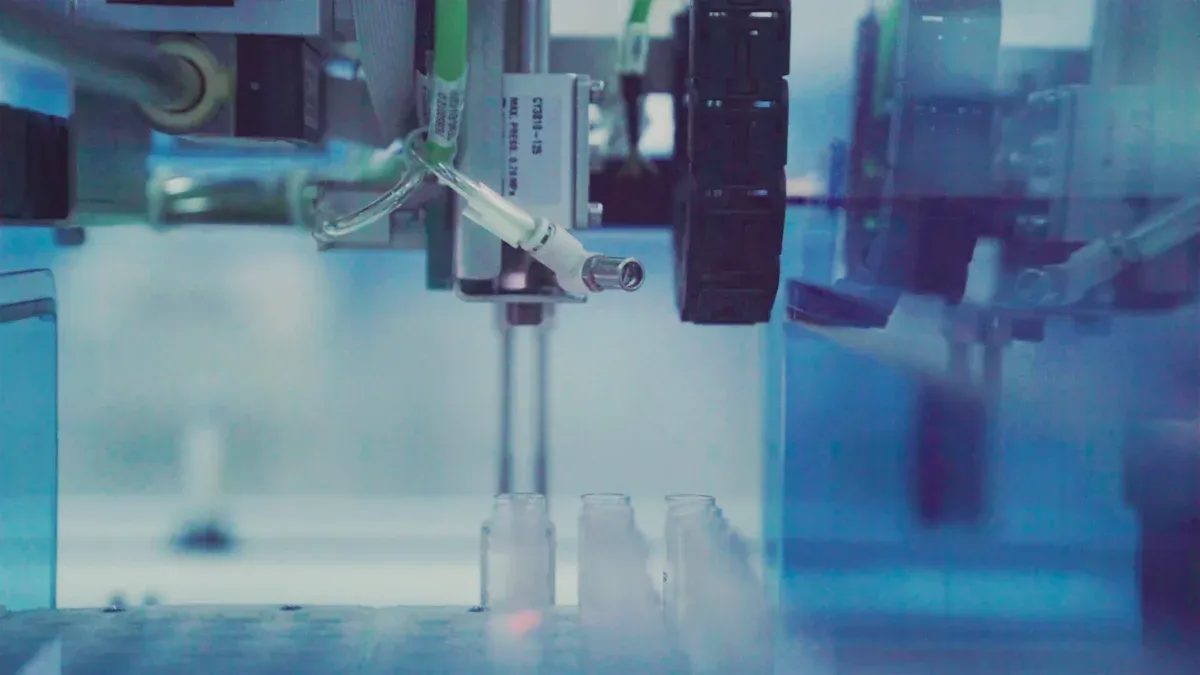

The global injection molding market is experiencing robust growth due to several key drivers. Packaging products are in high demand, with injection-molded solutions becoming essential for food safety and convenience. The automotive sector is another major contributor, as manufacturers increasingly rely on plastic injection molding for lightweight and durable components. Consumer electronics also play a significant role, with rising demand for precision-molded parts in devices like smartphones and laptops.

| Growth Driver | Description |

|---|---|

| High demand for packaging products | Significant increase in the need for injection-molded packaging solutions. |

| Usage in the automotive sector | Rapid growth in automotive applications driving market expansion. |

| Demand from consumer electronics | Rising need for injection-molded components in consumer electronics. |

| Opportunities in healthcare | Increased demand for precise medical device components creating growth. |

These drivers highlight the diverse applications of injection molding across industries, ensuring steady market expansion.

Despite its growth, the injection molding industry faces several challenges. Fluctuating raw material prices create uncertainty for manufacturers. Environmental regulations aimed at reducing plastic usage add pressure to adopt sustainable practices. Competing technologies, such as 3D printing, threaten traditional injection molding methods.

You must address these challenges proactively to remain competitive in the evolving market landscape.

Sustainability and technological innovation are reshaping the injection molding industry. The adoption of bio-based polymers has grown significantly, with these materials now accounting for 18% of usage in Europe. This shift reflects the industry's commitment to reducing environmental impact. Automation and smart technologies have also revolutionized production processes, cutting human error by 60% and improving defect detection rates by 35%.

Energy-efficient all-electric injection molding machines are gaining traction, offering reduced energy consumption and lower operational costs. The global bioplastics market, projected to reach $35.47 billion by 2027, underscores the increasing demand for biodegradable materials. Industry 4.0 technologies further enhance productivity, with reports suggesting a potential 15-20% improvement in efficiency.

By embracing these advancements, you can align your business with global sustainability goals while boosting operational performance.

Southeast Asia's injection molding industry is thriving due to the rapid expansion of key industries. The automotive sector leads the way, with a projected growth rate of 6.8% annually. The rise of electric and hybrid vehicles has increased the demand for high-quality injection molding machines. Electronics manufacturing also plays a significant role. Companies like LG Electronics and Samsung rely on injection molding to produce precision components for their products.

Healthcare is another major driver. Advanced technology and automation in medical device production have created a growing need for injection molding solutions. Packaging, especially for food and beverages, continues to expand. This industry benefits from the region's urbanization and rising consumer demand for convenience.

These industries highlight the diverse applications of injection molding in Southeast Asia's emerging markets.

Each country in Southeast Asia offers unique opportunities for the injection molding market. Vietnam has become a manufacturing powerhouse. Rising labor costs in China have driven companies to relocate to Vietnam, where foreign direct investment continues to grow. Thailand, known for its automotive industry, has seen significant growth in vehicle production. This trend has increased the demand for plastic components.

Indonesia's large population and growing economy make it a key player. The country's focus on infrastructure development has boosted demand for construction materials, including injection-molded products. Malaysia, with its advanced electronics industry, has emerged as a hub for high-tech manufacturing.

| Country | Key Opportunities |

|---|---|

| Vietnam | Manufacturing hub with increasing foreign direct investment. |

| Thailand | Automotive industry driving demand for injection-molded components. |

| Indonesia | Infrastructure development creating demand for construction-related products. |

| Malaysia | Advanced electronics industry supporting high-tech injection molding solutions. |

By understanding these country-specific opportunities, you can strategically position your business in the region.

The growing middle class in Southeast Asia has transformed consumer demand for injection-molded products. Rising disposable incomes and urbanization have fueled the need for consumer goods. This shift has created opportunities for manufacturers to meet the increasing demand for plastic packaging, automotive components, and household products.

The automotive sector has particularly benefited from this demographic change. Increased automobile manufacturing and sales have driven the demand for plastic components. Similarly, the food and beverage industry has seen a surge in demand for plastic packaging solutions. Urbanization has also contributed to the growth of the electronics and healthcare industries, further boosting the need for injection molding machines.

This demographic shift underscores the importance of aligning your business with the evolving needs of Southeast Asia's middle class. By doing so, you can tap into one of the most promising emerging markets for injection molding.

The injection molding industry in Southeast Asia features a dynamic mix of local and international players. Local companies often excel in cost efficiency and adaptability. They understand regional preferences and can quickly adjust to market demands. On the other hand, international competitors bring advanced technologies and established global networks. These companies often dominate high-tech sectors like electronics and healthcare.

A comparative analysis of market data from 2019 to 2024 highlights these differences:

| Category | Time Period | Data Type |

|---|---|---|

| Sales by Company | 2019-2023 | Units sold |

| Market Share by Company | 2019-2023 | Percentage |

| Revenue by Company | 2019-2023 | US$ Million |

| Sales by Type | 2019-2024 | Units sold |

| Market Share by Type | 2019-2024 | Percentage |

| Sales by Application | 2019-2024 | Units sold |

| Market Share by Application | 2019-2024 | Percentage |

| Projections for 2025-2030 | Various | Units and Revenue |

This competitive landscape creates opportunities for collaboration and innovation. You can leverage partnerships with local firms to gain insights into consumer behavior while utilizing international expertise to enhance product quality.

Government policies and trade agreements significantly shape the injection molding market in Southeast Asia. Many countries in the region offer tax incentives and subsidies to attract foreign investment. For example, Vietnam's government has implemented policies to support manufacturing growth, making it a preferred destination for global companies.

Trade agreements like the Regional Comprehensive Economic Partnership (RCEP) further enhance market accessibility. These agreements reduce tariffs and simplify cross-border trade, enabling you to expand your operations more efficiently. However, navigating these policies requires careful planning. Staying informed about regulatory changes can help you maximize the benefits of these initiatives.

Operating in Southeast Asia's injection molding industry comes with its challenges. Quality control remains a significant issue, especially in regulated sectors like healthcare. Many manufacturers struggle with maintaining consistent quality documentation and process control.

| Challenge Type | Statistic |

|---|---|

| Quality Control | Manufacturers struggle with quality documentation and process control, impacting regulated sectors. |

| Environmental Regulations | 20% of small and medium-sized molding businesses may shut down by 2025 due to financial constraints. |

| Geopolitical Tensions | 15% of U.S. clients have relocated production to avoid tariffs, affecting supply chain dynamics. |

| Workforce Patterns | The average workforce age in injection molding has increased from 27 to 36 since 2010, raising costs. |

To overcome these obstacles, you should invest in workforce training and adopt advanced technologies. Automation can improve quality control, while sustainable practices can help you comply with environmental regulations. By addressing these challenges proactively, you can position your business for long-term success in this competitive market.

Strategic partnerships play a vital role in succeeding in Southeast Asia's injection molding market. Collaborating with local businesses allows you to tap into their regional expertise and established networks. These partnerships can help you navigate cultural nuances, regulatory requirements, and consumer preferences more effectively.

For example, partnering with local suppliers can streamline your supply chain and reduce operational costs. Similarly, alliances with regional distributors can expand your market reach and improve customer access to your products. Joint ventures with local manufacturers also enable you to share resources and technology, fostering innovation and efficiency.

Tip: Focus on building long-term relationships with reliable partners. Trust and mutual understanding are key to successful collaborations in Southeast Asia.

By forming strategic partnerships, you can strengthen your foothold in the region and capitalize on its growing demand for injection molding solutions.

Adopting advanced technologies is essential for staying competitive in the injection molding industry. Modern machines offer higher precision, faster production cycles, and improved energy efficiency. These benefits are particularly important in emerging markets, where industries like automotive, electronics, and healthcare demand high-quality plastic injection molding solutions.

| Factor | Description |

|---|---|

| Demand for High-Precision Parts | Rising demand from various industries drives the need for advanced technologies. |

| Automation Adoption | Increasing automation across manufacturing sectors enhances efficiency. |

| Technological Advancements | Continuous improvements in machine design and functionality support adoption. |

| Government Policies | Supportive policies in key regions promote advanced manufacturing technologies. |

Automation is a game-changer in this field. It reduces human error, enhances quality control, and boosts productivity. Energy-efficient machines, such as all-electric injection molding systems, align with sustainability goals while lowering operational costs.

By investing in advanced technologies, you can meet the growing demand for high-quality products while improving your operational efficiency.

Thorough market research is crucial for understanding the unique dynamics of Southeast Asia's injection molding industry. This process helps you identify opportunities, assess competition, and tailor your strategies to meet local needs.

Several methodologies can guide your research:

| Methodology Type | Description |

|---|---|

| Data Triangulation | Combining multiple data sources to validate findings. |

| Top-Down Approach | Starting from a broad market overview and narrowing down to specifics. |

| Bottom-Up Approach | Building market estimates from the ground up based on individual segments. |

| Primary Research | Collecting original data through surveys and interviews. |

| Secondary Research | Analyzing existing data and reports for insights. |

Focus on industries driving demand, such as automotive, electronics, packaging, and healthcare. For instance, the automotive sector's growth in Thailand and Indonesia highlights the need for injection-molded components. Similarly, the electronics industry in Malaysia and Vietnam creates opportunities for high-precision molding solutions.

Note: Use a mix of primary and secondary research to gain a comprehensive understanding of the market. Surveys and interviews can provide firsthand insights, while existing reports offer valuable context.

By conducting in-depth research, you can make informed decisions and position your business for success in Southeast Asia's emerging markets.

Customizing injection molding solutions to fit local market needs is essential for success in Southeast Asia. Each country in the region has unique demands shaped by its industries, policies, and consumer preferences. Tailoring your approach ensures that your products and services align with these specific requirements, giving you a competitive edge.

Southeast Asia's manufacturing sector is growing rapidly, with an annual growth rate exceeding 5%. Rising labor costs in China have pushed companies to seek cost-effective production locations, making this region a prime destination. However, this growth comes with diverse challenges. For example, stricter environmental regulations require manufacturers to adopt energy-efficient machinery. Similarly, the rise of e-commerce has increased demand for diverse and flexible production capabilities.

| Evidence Type | Description |

|---|---|

| Economic Growth | Southeast Asia’s manufacturing sector is expected to grow at over 5% annually due to rising labor costs in China and a shift towards cost-effective production locations. |

| Technological Advancements | Adoption of Industry 4.0 principles and IoT devices enhances productivity and efficiency in manufacturing processes. |

| Local Policy Initiatives | Policies like India’s 'Make in India' campaign encourage domestic production, impacting demand for modern injection molding technologies. |

| Environmental Compliance | Stricter environmental regulations drive manufacturers to adopt energy-efficient machinery, influencing their purchasing decisions. |

| E-commerce Influence | The rise of e-commerce leads to increased product diversity requirements, necessitating flexible production capabilities. |

By understanding these factors, you can adapt your injection molding solutions to meet the specific needs of each country.

Understand Local Industries

Focus on the industries driving demand in each country. For instance, Thailand's automotive sector requires lightweight plastic components, while Malaysia's electronics industry demands high-precision parts. By identifying these needs, you can develop specialized solutions that cater to each market.

Leverage Advanced Technologies

Adopting Industry 4.0 principles, such as IoT-enabled injection molding machines, can enhance your ability to customize products. These technologies improve efficiency and allow for greater flexibility in production. For example, you can quickly adjust designs to meet the unique specifications of local clients.

Comply with Environmental Standards

Stricter environmental regulations in Southeast Asia require manufacturers to prioritize sustainability. Energy-efficient injection molding machines not only help you comply with these standards but also reduce operational costs. This approach aligns with the growing demand for eco-friendly products in the region.

Adapt to Consumer Preferences

The rise of e-commerce has transformed consumer expectations. Customers now demand a wider variety of products, often with shorter lead times. Flexible production capabilities enable you to meet these demands while maintaining high-quality standards.

Tip: Conduct regular market research to stay updated on local trends and regulations. This will help you refine your strategies and maintain a competitive edge.

Customizing your injection molding solutions to meet local market needs is not just a strategy—it’s a necessity. By aligning your operations with the unique demands of Southeast Asia, you can unlock new opportunities and drive long-term success.

Southeast Asia offers immense opportunities for the injection industry in 2025. Its growing middle class, expanding industries, and supportive policies create a fertile ground for businesses like yours. To succeed, focus on innovation, strategic planning, and adaptability.

These strategies ensure you stay competitive while meeting the region's unique demands. Southeast Asia's potential makes it a prime destination for injection molding businesses ready to innovate and adapt.

Southeast Asia offers a growing middle class, expanding industries, and supportive government policies. Countries like Vietnam and Indonesia attract manufacturers with cost-effective production and rising consumer demand. These factors create a fertile ground for injection molding businesses.

Adopt energy-efficient machines and use biodegradable materials. These practices help you comply with regulations while reducing costs. Sustainability also improves your brand image and aligns with consumer preferences for eco-friendly products.

Key industries include automotive, electronics, healthcare, and packaging. For example, Thailand’s automotive sector needs lightweight components, while Malaysia’s electronics industry demands precision parts. These industries fuel the region's injection molding growth.

Trade agreements like the RCEP reduce tariffs and simplify cross-border trade. These benefits improve market accessibility and lower operational costs. Staying informed about these agreements helps you maximize their advantages.

Each country has unique demands shaped by industries and policies. Customizing your solutions ensures alignment with local needs, such as eco-friendly products or high-precision components. This approach gives you a competitive edge in the market.